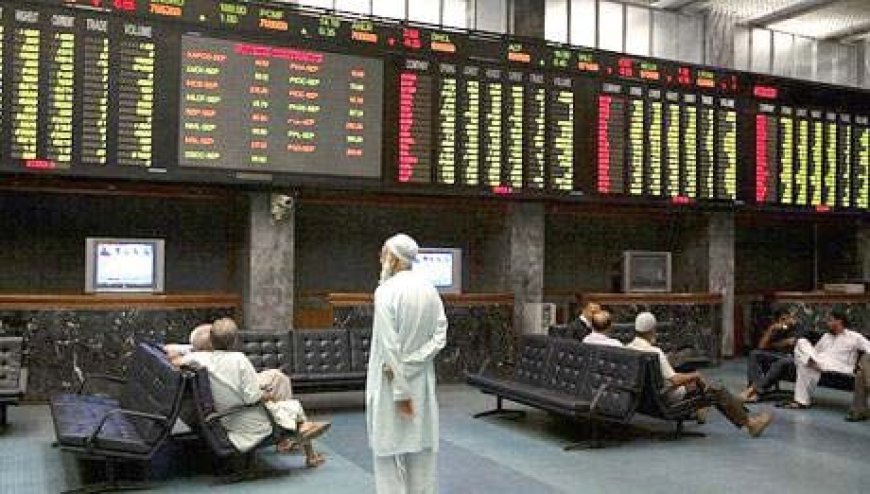

Pakistan Stock Exchange Hits Record High Amid Positive Investor Sentiment

The Pakistan Stock Exchange (PSX) continued its upward trend, with the KSE-100 index reaching a new peak on Thursday. The market saw gains in sectors like oil & gas, banking, and power, driven by improved foreign exchange reserves and stable geopolitical conditions.

Positive momentum continued at the Pakistan Stock Exchange (PSX) on Thursday as the KSE-100 index extended its upward trajectory to close at a new all-time high with addition of 342.63 points.

Investor sentiment remained robust, which propelled the benchmark index to intra-day high of 131,325. At close, the market settled at 130,686.66, higher by 0.26%.

The rally was led by index-heavy sectors, particularly oil & gas, banking and power. However, overall trading remained mixed. Among major triggers, Pakistan’s foreign exchange reserves jumped $5.1 billion to $14.5 billion by the end of FY25. This rise reflects improvement in the current account balance and the realisation of planned inflows.

KTrade Securities wrote in its report that the bourse experienced a mixed day as the KSE-100 index encountered general profit-taking, especially in the banking segment.

Notable gains were witnessed in the oil & gas and power categories where Oil and Gas Development Company, UBL, Hub Power, Pakistan Petroleum and Askari Bank added the most points. The report predicted a broadly optimistic outlook, contingent on continued geopolitical stability.

Arif Habib Limited Deputy Head of Trading Ali Najib commented that the PSX witnessed a tug of war between bulls and bears throughout the session. Ultimately, the bulls prevailed, lifting the benchmark index by 343 points (+0.26%) to close at 130,687.

The session opened on a positive note following the State Bank of Pakistan’s announcement a day ago that its foreign exchange reserves stood at $14.5 billion at the close of FY25, in line with the commitment given to the International Monetary Fund (IMF), it mentioned.

The upbeat development triggered a bullish rally, pushing the index to intra-day high of 131,325 (+981 points, or 0.75%). However, the optimism proved short-lived as profit-taking set in, dragging the index to intra-day low of 129,776 (-568 points, or 0.44%), before buyers regained control.

Top contributors to the index included Oil and Gas Development Company, UBL, Hub Power, Pakistan Petroleum and Askari Bank, which collectively added 487 points. On the flip side, Bank AL Habib, MCB Bank, Meezan Bank, HBL and Millat Tractors pulled the index down by 493 points, AHL added.

Overall trading volumes decreased to 899.8 million shares compared with Wednesday’s tally of 1.03 billion. The value of shares traded was Rs43.3 billion. Shares of 468 companies were traded. Of these, 216 stocks closed higher, 236 fell and 16 remained unchanged.

According to the source: The Express Tribune.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0