Pakistan Stock Exchange Sees Strong Weekly Gains Amid Stable Economy

The Pakistan Stock Exchange (PSX) had a successful week with the KSE-100 index reaching a record high, driven by institutional buying and positive macroeconomic trends. The market saw a 6.1% increase, boosted by shifting liquidity dynamics and encouraging tax changes. Key sectors like commercial banks and technology contributed to the rally.

The Pakistan Stock Exchange (PSX) had a strong start to the new fiscal year, with the KSE-100 index gaining 6.1% during the week to close at a record high of 131,949.06 points. The rally was driven by institutional buying, a shift from fixed-income instruments to equities, and improving macroeconomic fundamentals.

Topline Securities Ltd attributed the surge to changes in liquidity dynamics following the Finance Act 2025-26, which increased withholding tax on savings and fixed deposits to 20% while keeping equity investment tax at 15%. This encouraged investors to move towards equities as yields fell.

The benchmark index added 7,570 points during the week, with average daily trading volumes increasing by 31.4% and average traded value rising by 33%. In dollar terms, average daily turnover reached $145.7m, up 31.9% week-on-week.

Stabilizing macroeconomic indicators, such as lower inflation and a narrowing trade deficit, supported the positive sentiment. Foreign exchange reserves held by the State Bank of Pakistan rose significantly, and the rupee remained stable against the dollar.

Major sectors contributing to the rally included commercial banks, fertilizers, technology, communication, and exploration and production. Foreign investors were net sellers, while local mutual funds and companies were net buyers.

Regulatory changes in electricity and gas tariffs, as well as the introduction of a New Energy Vehicle levy, impacted various sectors. Cement dispatches rose, driven by exports, while the oil marketing sector saw an increase in product offtake.

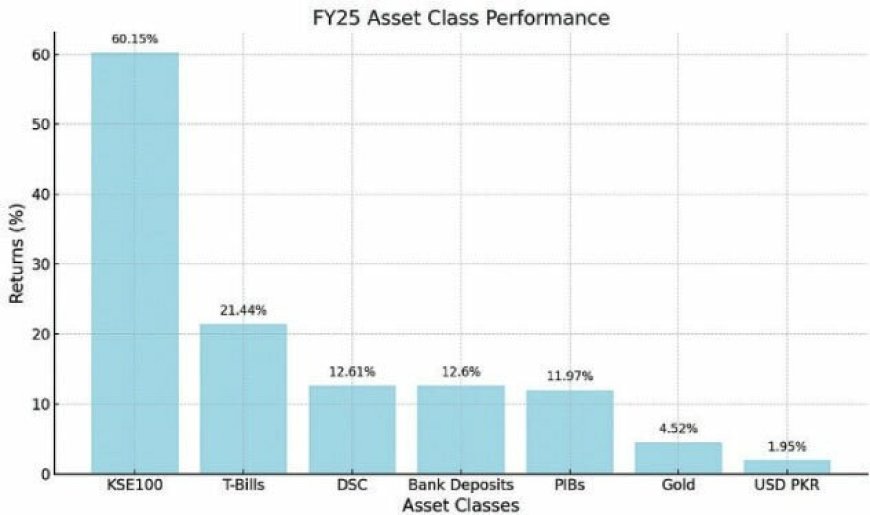

The KSE-100 outperformed other asset classes in FY25, with a return of 60.15%. Analysts expect the bullish momentum to continue, driven by positive investor sentiment and macroeconomic stability.

AKD Securities forecasts the index to reach 165,215 points by December, citing strong earnings in key sectors and the potential for further monetary easing.

Inflation for FY25 averaged 4.5%, with expectations of 4.4% for FY26, providing support for equities.

According to the source: Dawn.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0