Queensland Premier David Crisafulli Fails to Declare $200,000 Payment to Liquidators

Queensland Premier David Crisafulli did not disclose a $200,000 payout to liquidators pursuing an insolvent trading claim against him, as found by a parliamentary ethics committee. Despite being deemed 'careless', he was cleared of contempt of parliament due to lack of evidence. The report raised questions about the source of the payment and his financial situation.

Queensland Premier David Crisafulli failed to declare a $200,000 payout to liquidators pursuing an insolvent trading claim against him, a parliamentary committee has found.

The failure of Mr Crisafulli to list the liability on his MP register of interests was 'careless', the bipartisan ethics committee found in a report tabled on Friday.

But the committee absolved Mr Crisafulli of any contempt of parliament, saying it could not find adequate evidence that he had knowingly failed to disclose the payout tied to a private training company he had run.

Mr Crisafulli maintained the report had cleared him of wrongdoing but refused to answer how he had paid for the $200,000.

The committee's findings stem from exclusive ABC reports last year revealing liquidators of the training organisation SET Solutions believed it may have been trading insolvent from the day Mr Crisafulli started as a director.

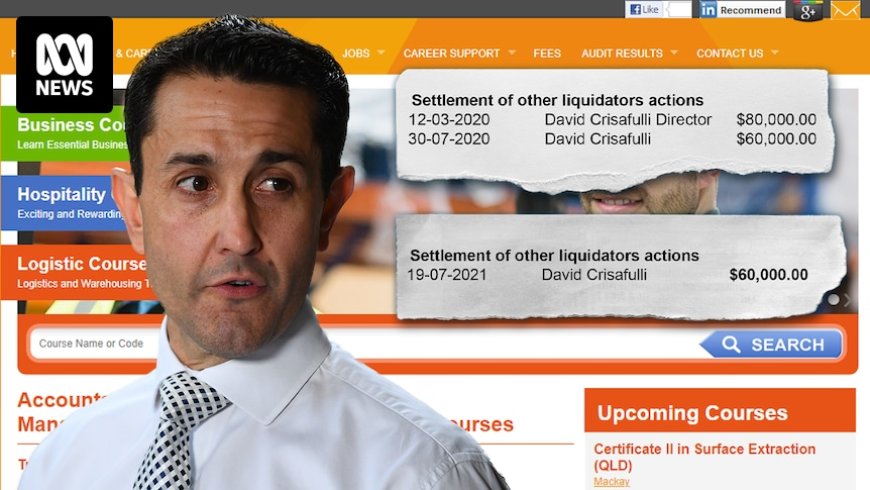

The ABC later revealed Mr Crisafulli had paid $200,000 to settle the insolvent trading claims.

During a break from politics in 2015, Mr Crisafulli took a job as sole director and chief executive of Melbourne-based SET Solutions.

The company received government funding to teach courses ranging from health administration to freight handling.

But the company had been struggling financially long before he took the role on December 1, 2015.

Mr Crisafulli only stayed until April 1, 2016, and the company collapsed into voluntary liquidation on June 30, 2016.

In 2018, Mr Crisafulli told parliament he left the company 'without a single mark of wrongdoing' against him.

Liquidators from PwC subsequently told creditors their investigations 'indicate the company appears to have traded while insolvent from at least December 1, 2015'.

They pursued an insolvent trading claim against Mr Crisafulli.

Mr Crisafulli signed a deed of settlement with the liquidators and made three payments while he was in Opposition: $80,000 in March 2020, $60,000 in July 2020, and $60,000 in July 2021.

'The payments were made with the joint understanding of no admission of liability and no findings made against me,' Mr Crisafulli told the ethics committee, in a letter tabled in its report.

MPs are required to declare liabilities of more than $19,000 but Mr Crisafulli disputed the notion the upcoming payment to the liquidators constituted the definition of liability.

'I note that the payments were made in order to compromise certain statutory claims that a party was threatening to pursue by litigation but which had not been established,' he wrote.

A finding of contempt of parliament would have required the committee to establish on the balance of probabilities that the premier knowingly failed to list the debt.

Mr Crisafulli maintained to the committee he never believed he had a liability to declare.

The committee determined there was 'evidence that the premier ought to have known that such payments were to be declared or at least sought the Registrar's advice'.

That included him having met with the Clerk of Parliament to discuss requirements of the register.

But Mr Crisafulli never sought advice about if he should have declared the liquidator debt.

'In hindsight, I should have sought the advice of the Clerk,' he told the committee.

The committee said Mr Crisafulli's thinking at the time 'appears to have been mistakenly focused on dealing with the issue in the context of director liabilities under corporate law rather than his register disclosure obligations'.

The committee also noted it could not 'identify how the alleged failure to declare the liability would give rise to a conflict of interest or a perception of a conflict of interest between the premier's private interests and the public interest'.

Mr Crisafulli declined to discuss whether he had been under any financial stress at the time the payments were being made.

Listed assets and liabilities on Mr Crisafulli's register at the time include a multi-property portfolio and six mortgages with Bank of Queensland.

Mr Crisafulli's splitting of $200,000 in liquidation settlement payments into three tranches over 16 months raised speculation within the insolvency industry about whether it indicated a degree of financial strain.

The ABC can reveal that 10 months after that last payment was made, Mr Crisafulli's private family company Crisafulli Financial Services offloaded a property in Townsville for $230,000 — crystallising a $57,000 gross loss after holding the property for almost 12 years.

Advertisements for the sale, which conceded the property 'needs work', show a rapid push to sell with the price heavily knocked down.

Deputy Opposition Leader Cameron Dick pointed to Mr Crisafulli last year maintaining he had met his obligations, when asked if he should have declared the liquidator liability.

'David Crisafulli has been saying over and over that's he complied with his obligations. Well, he did not,' he said.

Mr Dick says the report shows 'in black and white' that Mr Crisafulli did not comply with obligations.

'That is in black and white in this report.

Mr Dick also said serious questions remained for Mr Crisafulli to answer how the settlement payment was made.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0